Notice: We are not able to board RUO peptides at this time.

Ready to Start Processing?

Get approved in as little as 24 hours. No setup fees, no hidden costs.

Get approved in as little as 24 hours. No setup fees, no hidden costs.

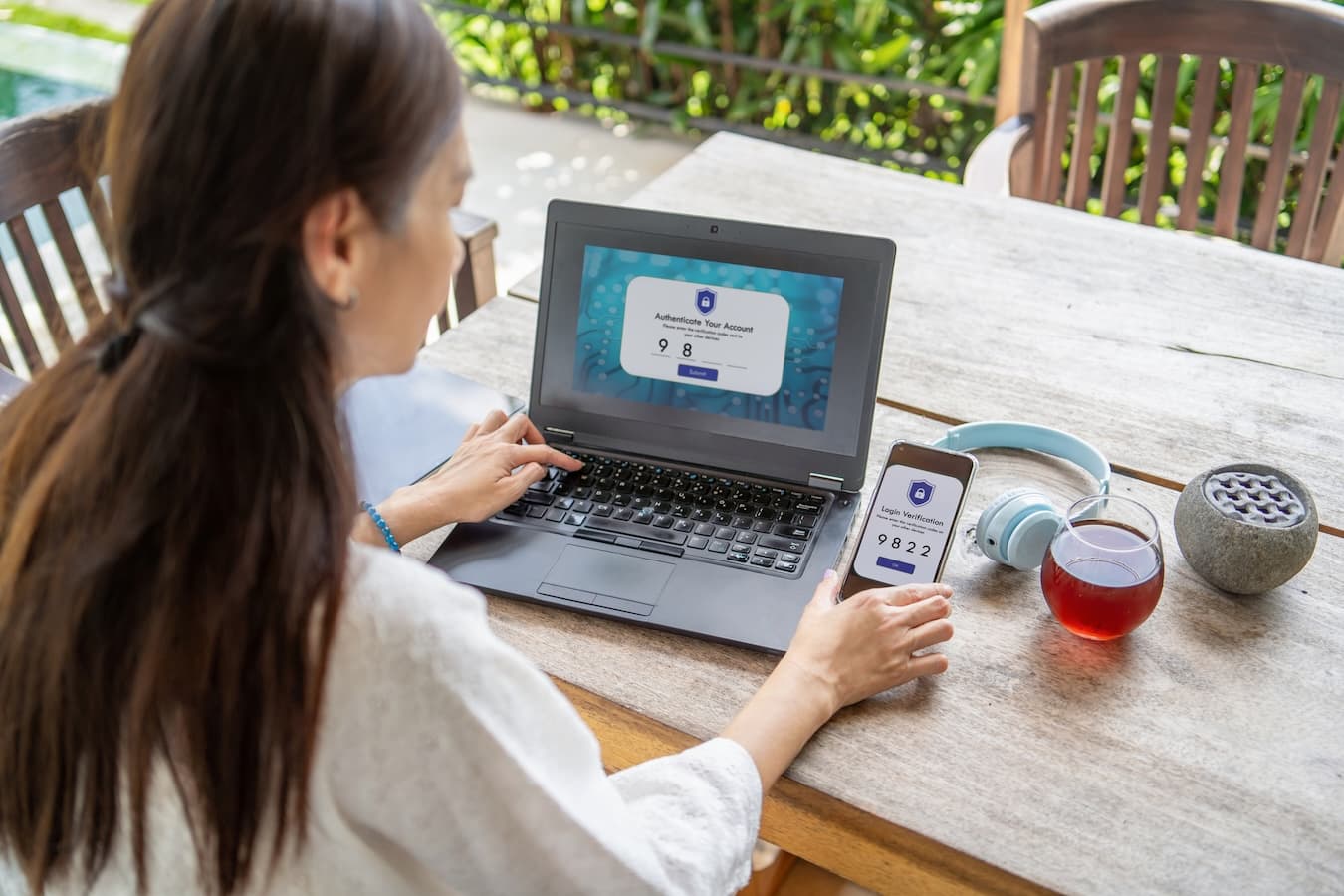

Enhance your online transactions with the advanced security of 3D secure payment gateways

If you process online payments, you've heard of 3D Secure. But what is it? In short, 3D Secure (sometimes called Visa Secure) is an additional authentication process created by Visa and MasterCard to add an additional layer of security for Card Not Present (CNP) merchants. Moreover, 3D Secure ties the financial authorization process with online authentication based on a three-domain model (3D). The three domains consist of:

Set Up Your Merchant Account in Four Easy Steps

Submit your application to get started with 3D Secure payment processing.

Submit the required documentation to complete the application process.

Our underwriting team will review your application and documentation.

Once approved, you can activate your account and start accepting payments.

Everything you need to know about high-risk payment processing